Car Insurance Ncb Percentage

How expensive rare and powerful your. Benefits of NCB in Two-Wheeler Insurance.

Importance Of No Claim Bonus In Car Insurance

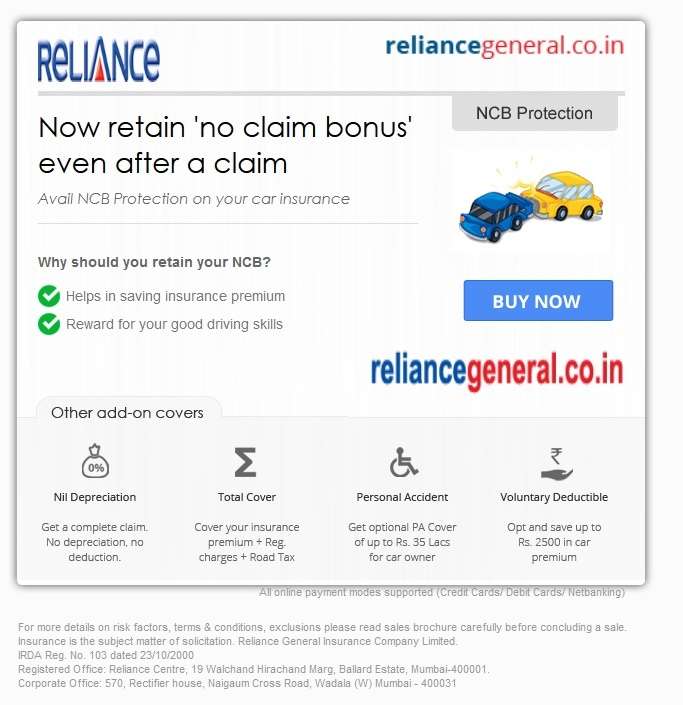

It is offered in the form of a discount that ranges from 20-50 and is available at the time of motor insurance renewal.

. The higher up the group the more expensive the insurance until you get to group 50 which is the most expensive for insurance. There may also be instances where you end up damaging property or hurting others in an accident. Loss of NCB Benefit - The NCB of your car insurance can be terminated if your car insurance plan is not renewed within 90 days of its expiry date.

BuyRenew Car Insurance policy online with upto 78 off. This percentage will increase with every claim-free year reaching 50 after 5 years and resetting to zero when you make a claim. In motor insurance a No Claim Bonus NCB is a reward offered to a policyholder who did not raise any insurance claim during a policy year.

You do not have to perform complex mathematical calculations. As per this benefit each year that you go without making a claim on your policy you will earn a bonus. All you have to do is input basic details about the vehicle for which you want to calculate the premium like.

No-claims bonus NCB. Your no claims bonus increases after every claim-free year on your policy renewal. For example you can earn a 20 NCB after the first year of having no claim under your car insurance policy.

A No Claim Bonus is an important part of the vehicle insurance policy as it provides relief from the ever-rising inflation. Drivers who know the tips can save money on car insurance. It does everything for you while you sit back and relax.

This can make you lose your NCB discount even if it was 50 which could be a huge loss for you as it could lower your premium for the next year. Get an instant quote for your car. It is the same as the claim in car insurance.

Car Insurance Premium Calculator is a free online tool which enables you to calculate the car insurance premium for your car vehicle within minutes. ICICI Lombards car insurance plan offers Easy Renewal 4300 Network Garages 24x7 Roadside Assistance Quick Claims. This way you end up reducing the cost of insurance with each passing year.

The cashless claim is where the insurance provider pays for the damage caused to the two-wheeler in an accident. If your car insurance is up for renewal there are a number of steps you can. After reaching 50 in the 5th year your NCB stops.

The insurer needs to repair hisher two-wheeler at the network garage of the insurance provider whereas Reimbursement-Claim or Non-Cashless is where the. Car insurance or motor insurance acts as a shield that protects you from incurring financial losses due to theft natural calamities damage from accidents and any subsequent liabilitiesCar insurance can cover third party vehicle as well as your own vehicle. An abbreviation for no claim bonus NCB is an extra benefit that is provided with a bike insurance policy.

Scope for Inspection - If your policy expires your insurance company might want the car before. Cars that fall into group 1 are the cheapest cars to insure. The group that your car insurance falls in is a factor that helps determine how much your car insurance premium will be.

Moreover the percentage of bonus offered grows with back-to-back claim-free.

No Claim Bonus Things You Need To Know

What Is Ncb In Insurance No Claim Bonus In Car Insurance Explained

What Is Ncb In Insurance No Claim Bonus In Car Insurance Explained

No Claim Bonus Ncb With Your Motor Insurance Policy Reliance General Insurance

Top 12 Real World Car Insurance Queries Answered Faqs

What Is Ncb In Car Insurance Benefits Of No Claim Bonus Paytm Blog

Did You Know The Interesting Fact Sheet On Motor Insurance Policy In India Life Insurance Facts Insurance Policy Car Insurance

What Is No Claim Bonus In Car Insurance Abc Of Money

Does Filing A Two Wheeler Insurance Claim Increase Your Premium Rates Motorbike Insurance Compare Insurance Insurance

0 Response to "Car Insurance Ncb Percentage"

Post a Comment